During a virtual investor roundtable, members of the Africa Investment Forum team showed two projects as the continent strives to enhance its healthcare industry and attract much-needed investment in the aftermath of the Covid-19 outbreak.

The projects, which are valued around $140 million and are located in East and West Africa, were showcased for possible investors.

The first chance, with a project cost of $96 million, is for the establishment of a 250-bed specialized hospital delivering world-class healthcare services in a West African country. The land has been obtained and feasibility assessments have been conducted.

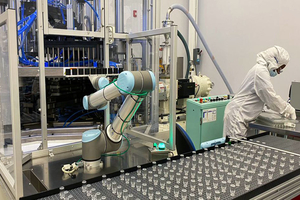

The second involves the development of a $45 million WHO-prequalified vaccine manufacturing factory in East Africa, which will be capable of producing three vaccines on a regular basis, including Covid-19.

Following the talks, a panel of investors shared their perspectives on investing in Africa’s healthcare industry. The panelists included Rhulani Nhlaniki, Pfizer’s Sub-Saharan Africa Cluster Lead; Jean-Philippe Syed, Principal at private equity firm Development Partners International; Afsane Jetha, Managing Partner & CEO at private equity firm Alta Semper Capital; Stavros Nicolaou, Aspen Pharmacare’s Senior Executive – Strategic Trade; and Dr. Dumani Kula, Evercare Group’s Chief Operating Officer for Africa. Aubrey Hruby, Senior Fellow of the Atlantic Council’s Africa Center, moderated the discussion.

According to Nicolaou, the fact that Africa has the largest illness load of any continent makes preventative treatment, including vaccinations, all the more crucial for Africans. The increased demand for medicines will need the formation of partnerships capable of overcoming obstacles such as research and development.

Other difficulties raised by attendees included overcoming cold chain and last-mile delivery issues, as well as approaches to scale up experimental technologies such as the use of drones to aid vaccination distribution.

The Africa Investment Forum’s Unified Response to Covid-19 pillars include health as one of five priority investment areas. Agribusiness, energy and climate change, ICT/Telecoms, and industrialisation and commerce are the others.

Last week, Africa Investment Forum Senior Director Chinelo Anohu mentioned the East Africa vaccine facility idea in the context of Africa’s present restricted access to Covid-19 vaccinations at a panel discussion hosted by the University of Edinburgh. Anohu believes that the continent may prevent vaccination inequities through trade and investment, particularly in its pharmaceutical industry.