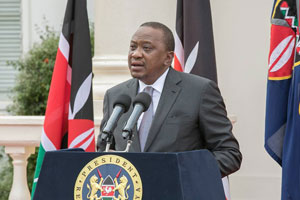

The Kenyan administration has allocated funds towards building new modern dental and eye facilities in referral hospitals in the nation. This is an initiative of President Uhuru Kenyatta who has mandated these centers to be completed within a 12 month period.

The president further revealed that his government will set aside Sh300 million for each hospital including prominent facilities like Kenyatta National and others, speaking at the inauguration of a new Sh275 million ultra-modern Dental and Eye Center.

“I have seen what less than Sh300 million can do to uplift the lives of Kenyans. I want to see similar facilities at Kenyatta, Moi, Nyeri and Mombasa [hospitals],” Uhuru said on Wednesday.

Kenyatta also went on to re-iterate his commitment towards achieving Universal Healthcare, which has been a very crucial part of his ‘Big Four’ agenda. He said that the role of the county governments will be of vital in its achievement.

Deputy President, William Ruto also added saying that every sector is going to be mobilized and will play a role in the transformation of Kenya.

“The transformation of Kenya will not happen if we do not mobilise every resource and every sector – NGOs, religious organisations and the public sector – so that we can push the transformation of our country under the agenda four items,” he said.